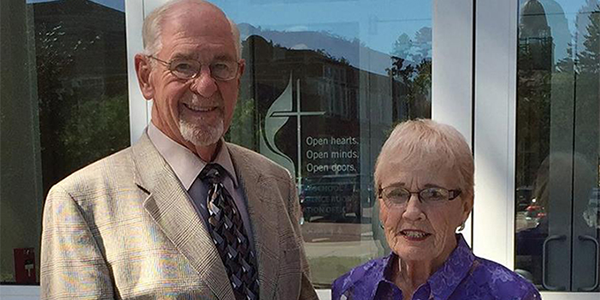

There's No Place Like Home – Howards Donate Through Jackrabbits Land Legacy

Richard and Kathryn Howard were determined to give to the SDSU programs they care about. To do that, they used their vacation home in Arizona as a funding mechanism for gifts to State.

Both 1962 graduates of SDSU, the Howards have deep ties to State. All six of their children went to SDSU, five of them on ROTC scholarships. They also count three of their children's spouses and three grandchildren among family members who attended SDSU. No wonder the Howards were the SDSU Family of the Year in 1994!

Rick and Kay met at SDSU after Rick transferred during his junior year from St. John's University in Minnesota. They met at a Halloween party at the Newman Center, where Kay was bobbing for apples.

Rick transferred to SDSU to get closer to home because his help was needed at the family business in Blunt. The family International Harvester business was established in Blunt in 1899.

"We had everything from teacups to iron," Rick said. He also went on to run a retail seed business for 36 years. In 1976, he started farming a few quarters of land that his father had owned, ending his farming career with 2,000 acres. Kay balanced her role as the mother of six with her job as a full-time substitute teacher in Blunt and Onida.

Their years in Blunt were busy with work and family. Rick was the fire chief and a first responder for 22 years. He also served on the city council.

In retirement, the couple first traveled to Arizona in 2000, eventually buying a winter home in Surprise. They live in Blunt from April through Thanksgiving.

Their Arizona home has become an integral part of their giving to SDSU. The Howards support a scholarship endowment to help students in the College of Arts, Humanities and Social Sciences who are part of the ROTC program. The gift of their vacation home, called a life estate, along with a separate estate bequest, will enhance their endowed scholarship while helping the economics, history, and music departments, as well as the Rodeo Club and SDSU Athletics, well into the future.

To form the life estate, the Howards deeded their home to the SDSU Foundation, realizing an immediate tax deduction. The Howards get to use the home throughout their lives, agreeing to pay property taxes, upkeep, and fees.

Life estates are irrevocable. However, once a donor decides to create a life estate, the benefits are plentiful.

Once the Howards no longer have need of the house, the Foundation will likely sell the property and use the proceeds to fund a variety of the Howards' interests at State.

Rick got his degree in economics and Kay's was in history. Those

departments will benefit, as well as the music department where Kay

participated in vocal music. The couple both have a soft spot for SDSU

Athletics.

Rick served as publicity chairman for the SDSU Rodeo Club, and it will

benefit as well.

Rick was more interested in publicity than he was in being a cowboy in

those days. He would dress as a rodeo clown for the Hobo Day Parade, but

that was as close as he got to the action.

"I was smart enough not to get on one of those animals," Rick said.

The Howards are humble and unaccepting when it comes to praise for their generosity. Kay sums up their philosophy best: "That's what you're supposed to do."