Smarter Giving Post Tax Reform

The passage of the Federal 2017 Tax Cuts & Jobs Act doubled the standard income tax deduction for the next five years. According to the Joint Congressional Committee on Tax, the number of itemizers is expected to decline from 45 million Americans to just under 18 million, effectively making cash gifts to charities the least tax-wise way to give.

Gifting assets like appreciated land or securities, tangible personal property such as grain, livestock, and depreciated farm equipment, or the incredibly potent Charitable IRA Rollover can have tremendous benefits for almost everyone.

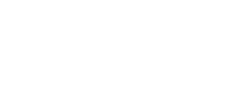

The chart below is a list of prioritized giving options which generally apply in most situations, both for those over the age of 70 and those under the age of 70.

Charitable IRA Rollover

If you are over the age of 70.5 utilizing the charitable IRA rollover is a smart way to make your annual charitable gifts while meeting your required minimum distribution.

Stevens '62 of Huntsville, Alabama, chose to use the charitable IRA rollover, or qualified charitable distribution (QCD), rather than writing a check to begin funding his endowed scholarship for civil engineering students active in U.S. Army ROTC. By using the charitable IRA rollover, he was able to satisfy his required minimum distribution without having to claim it as taxable income.

"It's a way to put the money to good use," Stevens said. "Providing scholarships to these students is a way of mentoring. My hope is these students will recognize the importance of supporting those that follow behind."

Individuals age 70 ½ or older are able to gift up to $105k from an IRA without recognizing taxable income. Additionally, for anyone who lives outside of the states of New York, Kentucky or Colorado, a QCD avoids "provisional income" that will likely save in Social Security and Medicare taxes.

Click here to learn about the charitable IRA rollover.

Tangible Personal Property

Jim and Melody Mielke never attended SDSU, yet they feel they've benefitted from SDSU educations throughout their professional lives. They wanted their legacy to be the investment in young people pursuing careers in the areas closest to them - agriculture and nursing.

With their farming roots, the Mielkes support their scholarships by gifting grain to the SDSU Foundation.

"This is our legacy," Melody says. "The students have been so gracious. The personal interaction with students is more than we expected."

There are significant tax benefits to gifting tangible personal property such as grain, livestock or machinery. The SDSU Foundation is able to make the sale tax-free, and donors like the Mielkes do not recognize any taxable income while still deducting their business expense of raising the livestock or grain. Further, the reduction in taxable income often reduces "provisional tax liability" (Medicare or Social Security taxable income).

Click here to learn more about gifts of land and land assets including grain, livestock, and machinery.

Appreciated Stock or Land

Ruth Bassett '57 of Highlands Ranch, CO, each year chooses to gift appreciated stock rather than write a check to fund her endowment and provide annual scholarships for P3 and P4 pharmacy students.

"It's really is a win-win situation," Bassett explained. "Gifting stock has always been my way of making charitable gifts. I bypass capital gains plus receive a tax deduction. I am grateful for the wonderful education I received at SDSU. Providing a scholarship is my way of giving back."

Now that capital gains' taxes have effectively increased in over 40 states since the passage of the new tax bill - since Americans can no longer deduct them on their Federal return - gifting appreciated assets like securities has more tax benefit than ever. When a taxable asset like stock is gifted to SDSU, the charity pays no tax when it is sold. Also, the donor is entitled to an income tax deduction.

Stock > Cash Gift

Income tax deduction

($100,000 x 35%)

$35,000

Income tax deduction

($100,000 x 35%)

$35,000

+

Avoid Capital Gains tax

($90,000 x 23.8%)

$21,420

The Charitable Stock-Swap

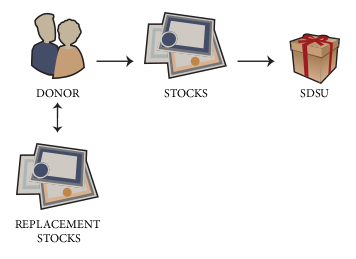

For those who hold appreciated securities, but are not inclined to give them away (preferring to hold them until they need them someday, usually for a major purchase in retirement), the Charitable Stock Swap makes a whole lot of sense. Assuming the donor has already committed to make a gift to a charity like SDSU, instead of writing a check to the charity, she writes the check to her brokerage or account administrator for the amount to be gifted.

While doing so, she instructs the broker or administrator to transfer her oldest, most appreciated shares in the stock to the charity for the intended gift-amount. Does the charity have more money as a result? No, but the donor herself tells the broker to purchase replacement shares of said stock (or perhaps begin diversifying) with the check she wrote to him, instead of to SDSU.

The concept is to begin positioning her portfolio to have higher-basis shares so that when she eventually does sell the stock, perhaps for a retirement apartment for example, her capital gains' tax liability is significantly less, thus leaving her more money in the end.

The Charitable Stock - Swap

No "wash sale" rule because this is gain property, not loss property.

Family Corporation Stock

There are three basic rules to the transfer of stock to a charity followed by redemption. Some corporations have excess liquidity building up inside the corporation and to declare dividends would subject the shareholder to additional personal tax. Consequently, it would be desirable to withdraw the liquidity from the corporation in a way that does not require tax to be paid by the shareholders. The gift and redemption concept achieves exactly those goals.

Stock is gifted by the owners to the charity. This gift entitled owners to take an income tax deduction plus to bypass the capital gain. After receiving the gift, the charity waits an appropriate period of time such as 2 or 3 weeks and then offers to sell that stock to that corporation. There can be no binding agreement and the sale must be at fair market value. The corporation then exchanges cash for the stock, which becomes Treasury stock in the hands of the corporation.

Primary benefits of this plan are that the shareholders receive a personal deduction and yet the gift of charity has been paid with the corporate dollars. In addition, the corporation has avoided the forced dividend and charity has obtained a substantial gift.